wikipedia David John Orrell (born 1962 in Edmonton) is a Canadian writer and mathematician. He received his doctorate in mathematics from the University of Oxford. His work in the prediction of complex systems such as the weather, genetics and the economy has been featured in New Scientist, the Financial Times, The Economist, Adbusters, BBC Radio, Russia-1, and CBC TV. He now conducts research and writes in the areas of systems biology and economics,[1] and runs a mathematical consultancy Systems Forecasting. He is the son of theatre historian and English professor John Orrell. His books have been translated into over ten languages. Apollo’s Arrow: The Science of Prediction and the Future of Everything was a national bestseller and finalist for the 2007 Canadian Science Writers’ Award. Economyths: Ten Ways Economics Gets It Wrong was a finalist for the 2011 National Business Book Award.

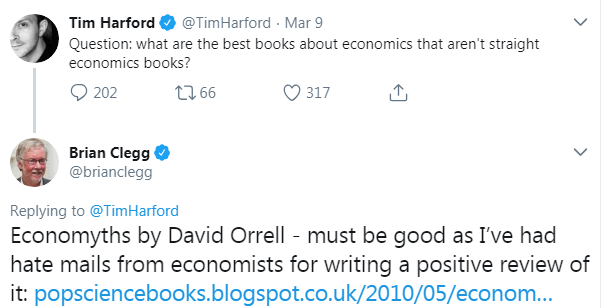

“Must be good as I’ve had hate mails from economists for writing a positive review of it” Brian Clegg

“In Economyths, David Orrell dramatically demonstrates that neo-classical economics, the basic economics still taught in our universities is absolute rubbish.” more here

David Orrell

- website – bio, books, articles

- blog – quantum economics and finance – video series

- scholar google citations

- YouTube

new article 2-2022

aeon.co 2-2022 A softer economics – Financial markets are entangled and uncertain. When will economists let go of physics envy to embrace the quantum revolution? by David Orrell

In her book Mother of Invention: How Good Ideas Get Ignored in an Economy Built for Men (2021), the writer Katrine Marçal argues that many useful innovations have failed to catch on because they are deemed ‘too feminine’ by marketers. A classic example is the wheeled suitcase. The wheel was invented in ancient Mesopotamia, however the possibility of attaching it to a case went against the whole idea of men showing off their strength by lugging heavy objects around, which is why wheeled suitcases weren’t a thing until 1972. As Marçal wrote in The Guardian: ‘Gender answers the riddle of why it took 5,000 years for us to put wheels on suitcases.’ Quantum is the scientific equivalent of suitcase wheels. The reason this useful innovation hasn’t caught on, or been rolled out, more generally in areas such as economics isn’t because it’s impractical or too hard – it’s because it’s too feminine. Or rather, too Female, in a sense to be defined below. Now, that assertion will seem ridiculous to many readers for a number of reasons…”…

books and reviews- new book 2-2022

iconbooks.com 2/2022 MONEY, MAGIC, AND HOW TO DISMANTLE A FINANCIAL BOMB – Quantum Economics for the Real World by DAVID ORRELL

Money has many apparently magical properties. It can be created out of the void – and vanish without so much as a puff of smoke. It can flash through space. It can grow without limit. And it can blow up without warning. David Orrell argues that the emerging discipline of quantum economics, of which he is at the forefront, is the key to shattering the illusions that prevent us from understanding money’s true nature. In this colourful tour of the history, philosophy and mathematics of money, Orrell demonstrates how everything makes much more sense when we replace our classical economic models with ones based on quantum probability – and reveals the explosive reality of what is left once the illusions are stripped away.

economist.com 11/2021 David Orrell shows up in The Economist

gmcaw: The Economist’s Buttonwood mentions David Orrell! Mind you it’s in the same disembedded manner in which heteros are occasionally allowed to represent “latest research”!;-D. Not a whisper about Orrell being DSGE-hate-mail attracting author of Economyths. To be fair, Buttonwood has a history of referencing heteros and heretics – up to a point. Use The Economist search button for Steve Keen and you discover entries up to 2013, ie just before Krugman had to put the phone down on their savings&loans exchange. Was Buttonwood a confused Krugman fan ? Try David Orrell in the search and you get zero. Apparently The Economist didn’t even review Economyths? Death threats perhaps?

…”Such similarities (between finance and physics) have spawned a niche area of research known as quantum finance. In a forthcoming book, “Money, Magic, and How to Dismantle a Financial Bomb”, David Orrell, one of its leading proponents, surveys the landscape. Mr Orrell argues that modelling markets with the mathematical toolbox of quantum mechanics could lead to a better understanding of them.

Classical financial models are rooted in the mathematical idea of the random walk. They start by dividing time into a series of steps, then imagine that at each step the value of a risky asset like a stock can go up or down by a small amount. Each jump is assigned a probability. After many steps, the probability distribution for the asset’s price looks like a bell curve centred on a point determined by the cumulative relative probabilities of the moves up and the moves down.

A quantum walk works differently. Rather than going up or down at each step, the asset’s price evolves as a “superposition” of the two possibilities, never nailed down unless measured in a transaction. At each step, the various possible paths interfere like waves, sometimes amplifying each other and sometimes cancelling out. This interference creates a very different probability distribution for the asset’s final price to that generated by the classical model. The bell curve is replaced by a series of peaks and troughs….”…

books and reviews

amazon 2020 Quantum Economics and Finance

“Written in clear and accessible language, this book covers the essential mathematics behind economic and finance topics such as quantum cognition, option pricing, and quantum game theory, and delves into the nuts and bolts of quantum mechanics, the principles of quantum economic modelling, and the basics of quantum computer logic.

The word “quantum” is from the Latin for “how much” and in this book mathematician David Orrell shows how it applies to the world of economic transactions. On the way the reader will learn how quantum interference can be used to model cognitive dissonance, how a quantum walk goes further than a random walk, and how financial entanglement explains the rate of mortgage default.

The book is aimed at anyone who wants to understand the quantum ideas working their way into economics and finance, without getting drowned in wave equations. As interest in quantum computing grows, many companies from established banks to startups are looking at ways to perform financial simulations using quantum algorithms. But what if we should be using quantum models anyway – because the monetary system has quantum properties of its own, and because they work?”

goodreads.com 2018 Quantum Economics – The New Science of Money

goodreads.com/review 2021 Brian Clegg review ….”…Although Orrell doesn’t claim to have all the answers, or the mechanisms to rework economic theory and practice, he shows how using parallels with quantum theory (sometimes verging on actual quantum behaviour) could be used to give economics a better chance of reflecting reality. …”…

medium.com 2020 Key Ideas of Quantum Economics – review of “Quantum Economics” by David Orrell, including direct quotes and commentary. Proceed with caution (and curiosity!). by Sebastian Mueller

In “Quantum Economics,” David Orrell argues that traditional economic theory, which excludes money as an object of inquiry, is misguided. In his view, money is a central matter, which needs detailed discussion. Further, borrowing from the field of quantum physics, he posits that money behaves much like a quantum object. This property of money has direct and severe implications for both the economy and society at large. Understanding, therefore, the nature of money is of the utmost importance to correct our understanding of the economy.

managementtoday.co.uk 2018 Does economics need a quantum revolution? David Orrell, author of Quantum Economics, explains why our understanding of money is all wrong.

zwischenzweideckeln.de podcast here 10-2021 QUANTUM ECONOMICS VON DAVID ORRELL

GGpdf english google translated transcript here

Nach ein paar politischen Episoden, erweitern wir das Themenspektrum diesmal ein wenig und begeben uns an die Schnittstelle zwischen Wirtschafts- und Naturwissenschaften. Unser Gast Holger stellt uns das Buch Quantum Economics von David Orell vor. Darin formuliert der Autor die These, dass die moderne Ökonomie noch immer mit den mathematischen Methoden des 19. Jahrhunderts arbeitet. Gerade mit der Quantenmechanik haben sich aber komplexe mathematische Modelle entwickelt, die auch ökonomische Zusammenhänge wesentlich angemessener abbilden können. hier hören

goodreads.com 2017 The Money Formula: Dodgy Finance, Pseudo Science, and How Mathematicians Took Over the Markets – by Paul Wilmott, David Orrell

internationalinvestment.net 2017 BOOK REVIEW: ‘The Money Formula: Dodgy Finance, Pseudo Science, and How Mathematicians Took Over the Markets’ – by Helen Burggrafclock

moneylife.com 2017 Quants with a Conscience – by Debashis Basu

More David Orrell books at goodreads or amazon.com

David Orrell articles

regular articles on worldfinance.com

D.Orrell/GM/PDF 2021 Ada Lovelace – MoneyFrom Nothing – A Deep Dive into Qunarum Economics by David Orrell

managementtoday.co.uk 2019 Does economics need a quantum revolution? David Orrell, author of Quantum Economics, explains why our understanding of money is all wrong.

worldfinance.com 2015 Economics’ big bipolar problem – Warring economists are stuffing up the discipline’s scientific credibility David Orrell

Readers of this column, no doubt concerned for my wellbeing, have occasionally asked how my book Economyths – a critique of mainstream economics from the point of view of an applied mathematician – was received by economists. The book, which also served as the basis for many Econoclast articles, did muster a number of positive reviews, from publications ranging from Bloomberg to Handelsblatt. The science writer Brian Clegg called it “probably one of the most important books I’ve ever read” (he’s not an economist, I just wanted to mention it, before we go on). Perhaps the strongest endorsement was from Czech economist Tomas Sedlacek, who co-wrote a subsequent book with me.

Not everyone was so complimentary. In an online discussion at the leading Canadian economics blog Worthwhile Canadian Initiative, a group of university economists, wrote off my book based on what they could find on Google, describing it variously as juvenile, idiotic, intellectually lazy, semi-articulated, ignorant, and “sort of like Malcolm Gladwell without the insight” (ouch). One poster even compared me to a climate change denier. They could have thrown a copy on a fire, if they’d bought one. …”…

Quantum propensity in economics (with Monireh Houshmand), Frontiers in Artificial Intelligence, 2021.

A quantum walk model of financial options, Wilmott Magazine, March 2021.

The Color of Money: Threshold Effects in Quantum Economics, Quantum Reports 3(2), 325-332, 2021.

Quantum-tative Finance, Wilmott Magazine, March 2020.

The value of value: a quantum approach to economics, security and international relations, Security Dialogue, 51(5), 482-498, 2020.

A Quantum Model of Supply and Demand, Physica A: Statistical Mechanics and its Applications 539C: 122928, 2020, preprint at SSRN,

Quantum Economics, Economic Thought, 7 (2), 63-81, 2018

A Quantum Theory of Money and Value, Part 2: The Uncertainty Principle, Economic Thought, 6 (2), 14-26, 2017

A Quantum Theory of Money and Value, Economic Thought, 5 (2), 19-28, 2016

Quantum financial entanglement: The case of strategic default, SSRN Discussion Paper, May 2019

A quantum oscillator model of stock markets, SSRN Discussion Paper, Oct 2021

BBEДEHИE B MATEMATИКУ КBAHTOBOЙ ЭКOHOMИКИ (Russian translation of mathematics primer)

quantum economics – collection

https://thenextweb.com/news/your-brain-might-be-quantum-computer-hallucinates-math

hackaday.com 2-2022 Hallo (many)quantum worlds

youtube The Audioped – Wikipedia.org What is QUANTUM ECONOMICS? What does QUANTUM ECONOMICS mean? QUANTUM ECONOMICS meaning

An early proponent of this approach was the Pakistani mathematician Asghar Qadir. In his 1978 paper Quantum Economics, he argued that the formalism of quantum mechanics is the best mathematical framework for modeling situations where “consumer behavior depends on infinitely many factors and that the consumer is not aware of any preference until the matter is brought up.” He proposed that, like particles in quantum mechanics, “the individual as an entity … can be thought of as a point in a Hilbert space.”

Qadir’s paper received little attention. However, during the 1990s, workers in the field of quantum cognition indeed showed that many aspects of human decision-making, including those involved in economic decisions, seemed to follow a kind of quantum logic. At the same time, researchers such as economist Martin Shubik and social scientist Emmanuel Haven were beginning to use the quantum formalism to model the uncertainty of stock markets.

In his 2007 book Quantum Finance: Path Integrals and Hamiltonians for Options and Interest Rates, Belal E. Baaquie showed how methods from quantum physics could be applied to things like the pricing of financial options. However he wrote that the ‘’larger question of applying the formalism and insights of (quantum) physics to economics, and which forms a part of the larger subject of econophysics, is left for future research.’’

In their 2013 book Quantum Social Science, Emmanuel Haven and Andrei Khrennikov extended Baaquie’s work in finance, and showed how quantum techniques could be used to model a number of issues in economics more broadly, such as arbitrage and the reflexivity theory of George Soros.

The mathematician David Orrell has argued that money has dualistic, quantum properties because of the way that it merges the exact concept of number with the fuzzy concept of value, and notes the similarities between how prices are assigned in the economy, and the measurement process in quantum systems. In the 2016 book The Evolution of Money, he and co-author Roman Chlupatý describe a “quantum economics” which incorporates these dualistic properties of money.

Just as quantum physics differs in fundamental ways from classical physics, quantum economics differs from neoclassical economics in a number of key respects.

Neoclassical economics is based on expected utility theory, which combines utility theory to model people’s preferences, and probability theory to model expectations under uncertainty. However the field of quantum cognition calls these assumptions into question, since people don’t necessarily have fixed preferences, or base their decisions on probability theory. Many of the findings of behavioral economics are inconsistent with classical logic, but agree with quantum decision theory of the sort assumed in quantum economics.

In financial applications, neoclassical economics is associated with the efficient market theory. As Haven and Khrennikov show, this condition has come under increasing question since the financial crisis, but can easily be relaxed using a quantum formalism.

Neoclassical economics assumes that people act independently while making economic decisions. Quantum economics notes that financial actors are part of an entangled system, as in quantum game theory.

Quantum economics also stresses the importance of financial transactions and in particular the role of money as an active force in the economy, for example in the way that it binds debtors and creditors. Quantum economics can therefore be viewed as an alternative to neoclassical economics which begins from a different set of assumptions.

chicagounbound.uchicago.edu 2018 Quantum Economics, Newtonian Economics, and Law by William HJ Hubbard

ABSTRACT – Just as Newtonian mechanics breaks down when we look at the constituent pieces of our universe-subatomic particles neoclassical economics breaks down when we look at the constituent pieces of our society individual people. At the scale of subatomic particles, quantum mechanics provides new foundations for understanding the physical world; at the scale of individual decisionmaking, behavioral economics promises new foundations for understanding the social, economic, and legal worlds. As this Article explains, this analogy between Newtonian and quantum physics, on

the one hand, and neoclassical and behavioral economics, on the other hand, has much to reveal about law and economics. With the help of numerous examples of key findings in behavioral law and economics, I take three principles from quantum mechanics (the uncertainty principle, the correspondence principle, and the quantum principle) and show how analogous principles in economics help illuminate the future trajectory of law and

economics. I then seek to accelerate this trajectory by proposing an agenda for strengthening behavioral law and economics through a stronger grounding in theory and specifically a “quantum” theory of decision-making.

Along the way, the analysis leads me to challenge some common misconceptions about law and economics:…”…

D.Orrell-nb-2022 “Qadir was as far as I know the first person to suggest the idea of quantum economics in a paper. He noted for example that decisions are affected by the order in which they were made. The same idea was demonstrated 30 years later by researchers in quantum cognition (though they were apparently unaware of Qadir’s paper which got no attention when it came out). So I would definitely view him as a key founder, though he didn’t consider the role of money which I think is important.

William Hubbard used quantum economics in the title of a paper, but in a completely different way. His argument was that quantum physics applies at the subatomic scale, but averages out at large scales. In the same way, he said, behavioural effects may be important at the level of individuals, but tend to aggregate out. So this is kind of the opposite of the quantum economics approach! And again, he doesn’t account for the effects of money, as a substance which scales up behavioural effects to the societal level.”

jstor.org/ 1978 Quantum Economics by Ashgar Qadir

ä ö ü Ä Ö Ü